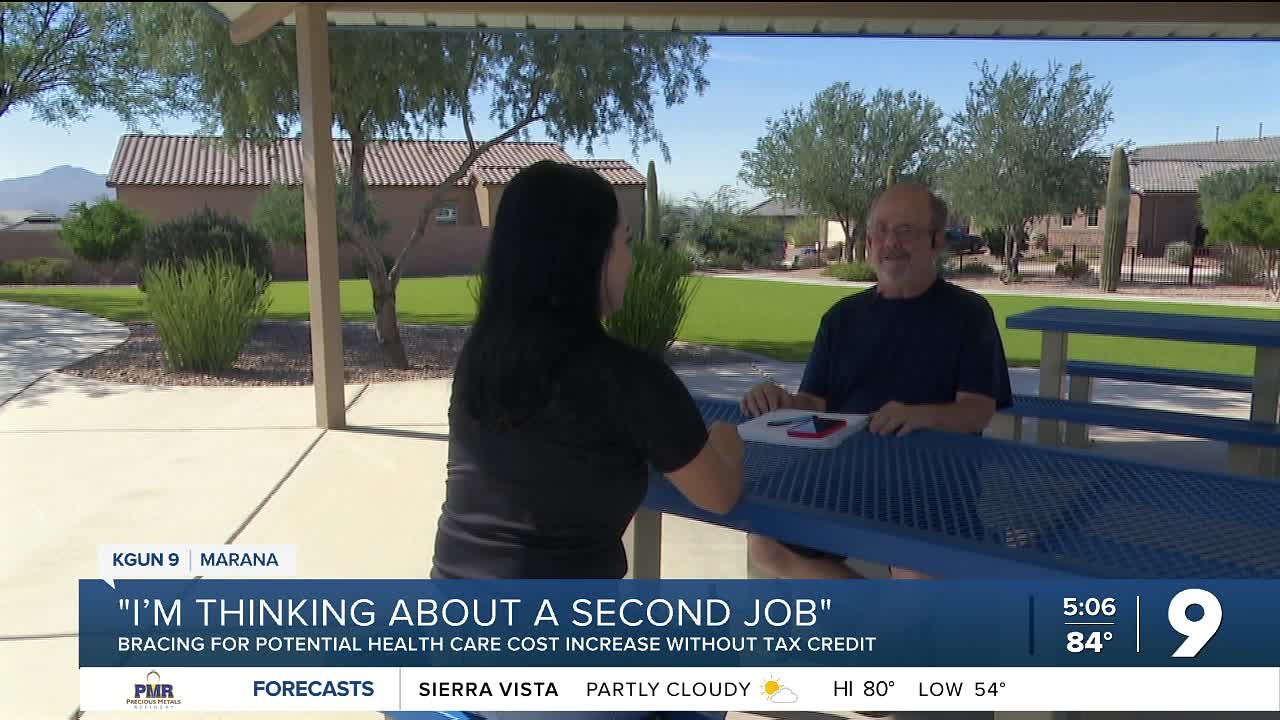

Brian Flahive is considering taking on a second job — not for extra spending money, but to afford health insurance.

The 60-year-old self-employed Marana resident with pre-existing conditions is among millions who could face higher health insurance costs next year.

"I thought I was going to be a couple hundred bucks higher, but I'm actually double - so $600 to $1200 a month," Flahive said.

That's what he says he would pay for coverage for himself and his teenage son.

KFF estimates that the expiration of enhanced premium tax credits at the end of the year would more than double what subsidized enrollees currently pay for premiums.

RELATED | Healthcare premiums could jump significantly as enhanced subsidies expire

Open enrollment for plans through the Health Insurance Marketplace started November 1, and consumers must enroll by December 15 for coverage to start January 1. More than 24 million people enrolled in Marketplace plans this past year.

With uncertainty surrounding the future of these subsidies, Flahive has been trying to figure out what to do as the enrollment deadline approaches.

"I hedge my bets, he said. "I have three different insurance agents that I've been constantly talking to."

He wants Congress to take proactive action before making any changes to current healthcare policies.

"Don't get rid of one without replacing it with another, because I have no options otherwise," Flahive said.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.