A group of residents in Colorado is fighting back after their Homeowners Association told them to pay $20,752.12 each for damage from a hailstorm in August.

The residents of the Soaring Eagles Townhomes, located on the southeast side of Colorado Springs, said they received a letter from an attorney on behalf of their HOA stating they have to pay the amount in less than a couple of months.

The amount owed was a loss assessment notice tied to a hailstorm that happened on or around Aug. 1, 2024, the HOA stated.

The letter, provided to the Scripps News Group station in Colorado Springs by some of the residents, was dated Aug. 18.

It read, in part, "The Association’s insurance policy has an applicable [deductible] of $3,112,817.26 for this claim. As permitted by the Declaration of Covenants, Conditions, and Restrictions of the Soaring Eagles Townhomes (the “Declaration”) and/or applicable Colorado state law, the Association has the right to assess this deductible against the units in any reasonable manner. The Association has elected to assess the deductible back to each unit in equal shares in the amount of $20,752.12 per unit."

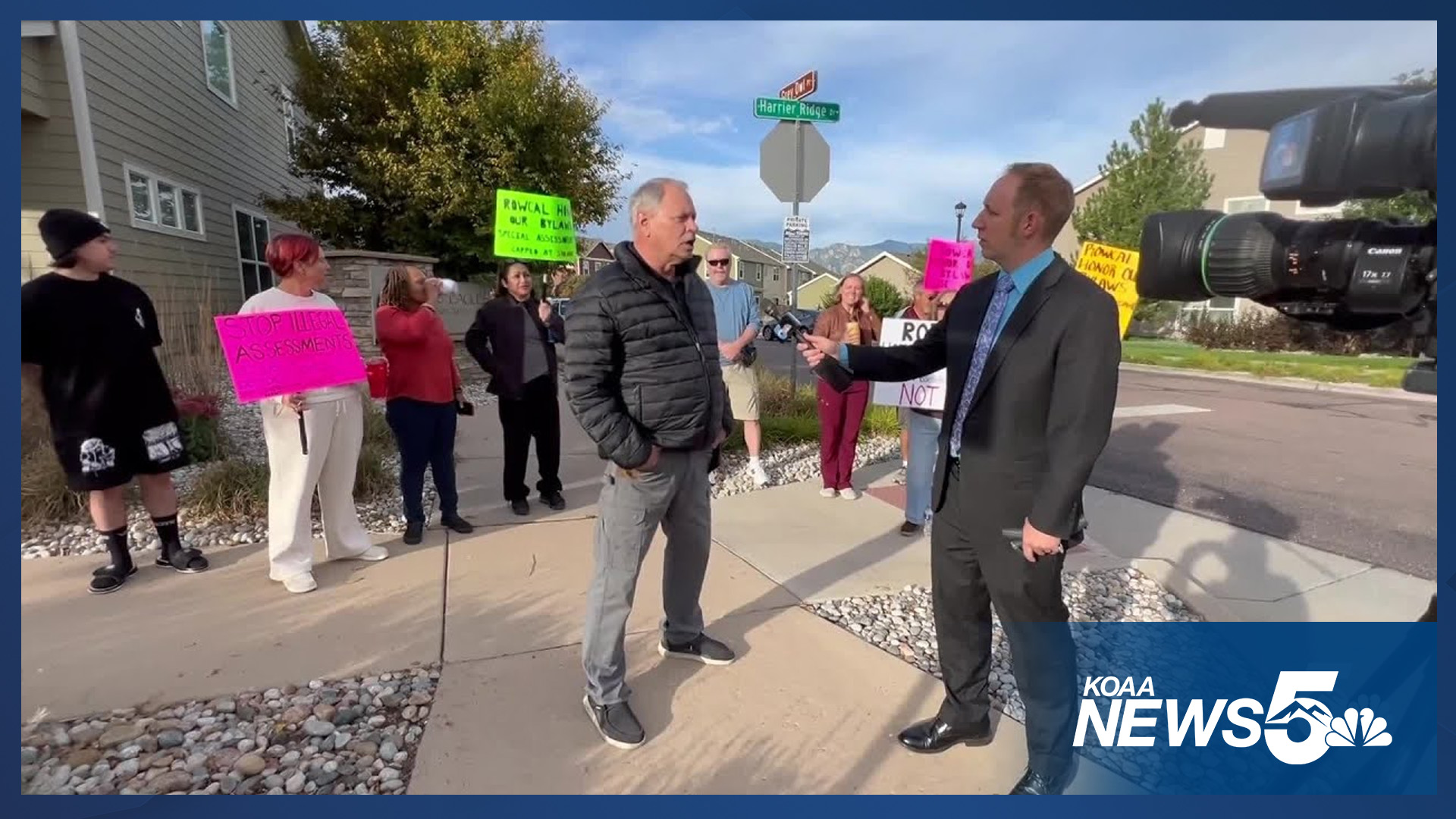

Heather McBroom just moved into the townhomes in May. She joined about a dozen of her neighbors on Monday morning in an effort to protest the work being done because of the high cost of the assessment.

McBroom, citing the HOA's declaration, said that the cap for a loss assessment is $10,000.

The residents were told their payments were due by Oct. 1, and some of them believe their insurance will only cover half, based on the coverage they have.

"We have about one-third of our members who are elderly or single-family parents that will not be able to cover that difference, nor should they have to," McBroom said as she protested. "They've already threatened to put liens and additional assessments and late fees on people who cannot pay it by October 1, or put it on a payment plan at 18 percent interest."

McBroom said she isn't arguing whether or not the work needs to be done, but that she just wants the HOA to respect the declaration or offer alternatives.

"It's a humane issue, right? We have people who literally cannot afford this and will lose their homes, and that's not fair," McBroom added. "They need to come back together. They need to have a special meeting with every member and figure out a more humane way to do this. We could do the damage. We could fix the damage in stages. We could offer payment plans with no additional penalties or interest. A number of different things could be done."

One of the people by McBroom's side on Monday morning was Rick Dommer, a former HOA president for the community.

While serving as the board president in the past, Dommer also had to handle insurance issues tied to a hailstorm.

"Things were a little different back then," Dommer said about his time serving as the HOA president. "All the homeowners would come together. We'd let them know what was going on, how much it was going to cost everybody. We kept everybody informed what was going to happen.... Right now, the way things are going with roll call, there is no communication. Everything is done on the computer. They send you an email, they send you a letter."

An attorney representing the board stated there was a town hall on the matter on Aug. 13 and that about 50 members attended.

McBroom said they plan on taking legal action.

The Scripps News Group station in Colorado Springs tried to make contact with multiple HOA board members and was unsuccessful. The board is tied to

Anthony Smith, an attorney with SJJ Law who is representing the HOA board, sent the following statement on the matter:

"We appreciate the opportunity to provide clarity on the recent deductible assessment issued by Soaring Eagles Townhomes Association, Inc. (“Soaring Eagles”) and to highlight the broader systemic issue that has led to this unfortunate situation.

On August 1, 2024, a severe hailstorm struck the Soaring Eagles community, causing extensive damage to roofs, gutters, fences, and other structural components. Following the event, Soaring Eagles filed a claim with its property insurance carrier, Falls Lake Fire & Casualty Company. The claim was adjusted by its hired adjuster, Claims Adjusting Group, Inc., which determined the total repair cost to be $3.6 million. The applicable deductible for the claim was $3.1 million, which represents 10% of the damaged property’s total insured value.

Consistent with its legal authority under Colorado law and the Association’s Declaration, Soaring Eagles’ Board of Directors assessed this deductible equally across the 150 homes in the community in the amount of $20,752.12 per home. While this figure is understandably alarming to homeowners, it is important to recognize that the Board did not make this decision lightly or arbitrarily. It is also important to recognize that the Board took steps to communicate this to the owners before it levied the special assessment. Among other things, the Board held a town hall meeting on August 13, 2025, to discuss the insurance claim and the deductible assessment. The town hall meeting was open to the community and was attended by approximately fifty members.

To help mitigate the impact of deductible assessments, Soaring Eagles has long encouraged homeowners to carry HO-6 policies with loss assessment coverage. These policies can reimburse owners for their share of an HOA’s deductible assessment, often reducing their actual out-of-pocket expense to $1,000 or less. Most owners throughout the community have HO-6 policies that covered the deductible assessment.

Soaring Eagles respectfully submits that the real issue here is not the deductible assessment, but the insurance market itself. When Soaring Eagles’ Declaration was drafted in 2006, it included a provision limiting deductibles to the lesser of $10,000 or 1% of the policy’s face value. Unfortunately, the insurance landscape has changed dramatically since then. Today, it is virtually impossible for HOAs in Colorado to obtain property insurance policies with fixed deductibles for wind and hail claims. The market has shifted to percentage-based deductibles, and HOA property insurance carriers in the Colorado market no longer offer policies with the kind of deductible envisioned in the Declaration. In short, Soaring Eagles cannot buy a property insurance policy that complies with the original deductible cap because no one is selling them.

Unfortunately, this problem is not unique to Soaring Eagles. Rather, it is a statewide problem that affects HOAs across Colorado. The insurance industry continues to increase the cost of property insurance for HOAs while simultaneously increasing the deductibles under those policies. In other words, HOAs are paying more money for less coverage. This situation will not improve unless lawmakers intervene. We urge affected residents to contact their state representatives and advocate for reforms that would:

· Cap wind/hail deductibles for HOA policies;

· Require HO-6 policies with loss assessment coverage for HOA members; and

· Hold insurance companies accountable for offering fair and accessible coverage.

The representatives for the Soaring Eagles residents are:

· Sen. Tony Exum – tony.exum.senate@coleg.gov

· Rep. Regina English – regina.english.house@coleg.gov

Soaring Eagles remains committed to transparency and support for its homeowners. We welcome further dialogue and are doing everything we can to navigate this difficult situation with fairness and compassion."

This story was originally published by Tony Keith with the Scripps News Group in Colorado Springs.