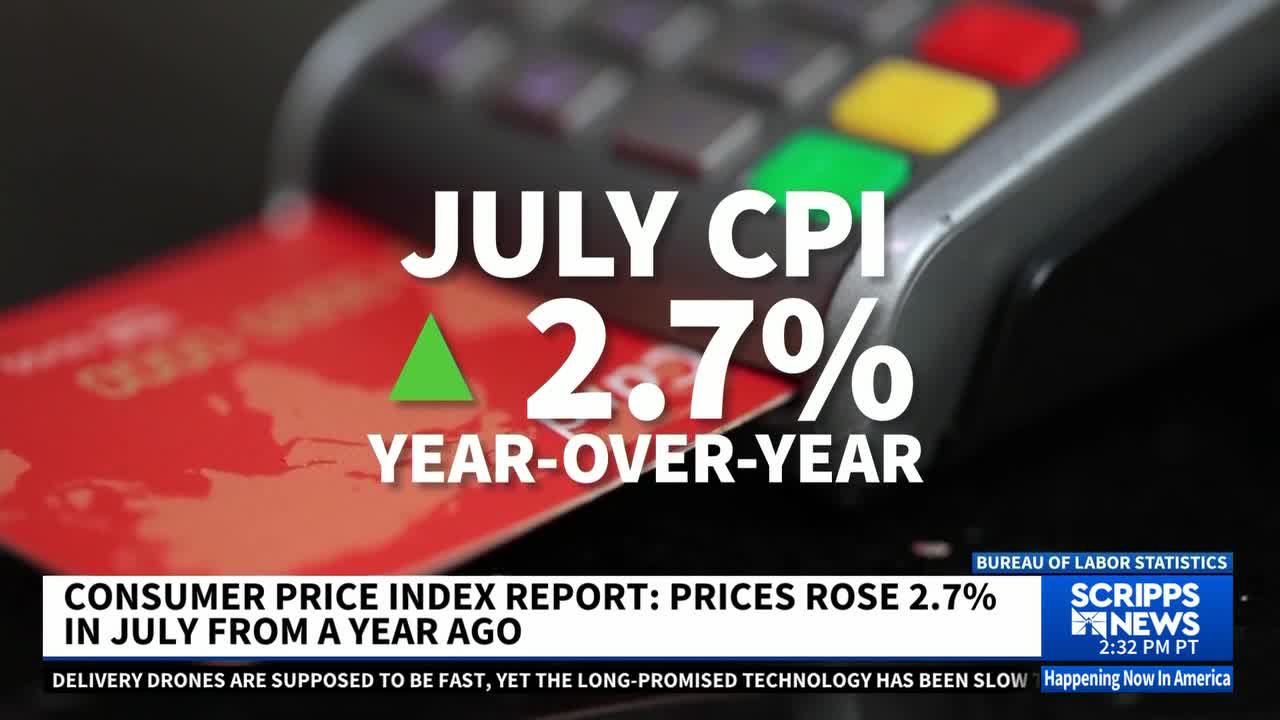

The U.S. inflation rate remained steady in July, according to new data from the Bureau of Labor Statistics.

According to new data released on Tuesday, the consumer price index remained at 2.7% in the 12-month period ending in July. It was also at 2.7% for the 12-month period ending in June. The inflation rate is 0.3 percentage points higher than May's rate of 2.4%, and 0.4 percentage points higher than April's consumer price index, which marked the lowest year-over-year inflation rate since 2021.

Tuesday's new data was the first consumer price index update since President Donald Trump fired the head of the Bureau of Labor Statistics Erika McEntarfer. On Monday, President Trump said he intends to nominate Heritage Foundation economist E.J. Antoni to head the BLS.

How much of a role President Donald Trump's tariff policies have played in inflation remains unclear. The inflation rate on items other than food and energy increased to 3.1% for the year ending in July, which is up from 2.9% in July and 2.8% in the previous three months.

Last week, the Budget Lab at Yale University said President Trump's tariffs would raise prices by almost 1.8% in the short run, costing the typical middle-class household more than $2,400 per year. Those figures have fluctuated as President Trump continues shifting tariff rates on various nations.

The consumer price index weighs the costs of goods based on their importance; items like food, shelter, and energy tend to be weighted more heavily. Tuesday's report showed the gasoline and shelter costs were a bit higher in June.

Apparel and footwear, which had actually seen prices decline over the previous year, saw price increases in June and July. Many experts said apparel and footwear could especially be vulnerable to import taxes, given that most of the clothes and shoes worn by Americans are imported.

Over the last decade, prices have generally increased at a rate of 3.5% per year. Over the last 20 years, consumer inflation has typically risen by 3.3% annually. The Federal Reserve, however, has aimed to keep annual inflation at approximately 2%.

The new data could help determine whether federal interest rates should be lowered. The Federal Reserve aims to keep inflation at around 2% while also maintaining robust hiring. As the BLS' recent job numbers showed a softening job market, some are expecting the Federal Reserve to lower interest rates at its next meeting.